Shift Report

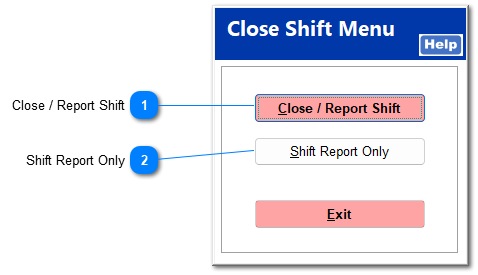

When closing a shift, you are given the opportunity to print a shift report. The report prints only the activity of the current workstation for that shift, corresponding to the ZNumber.

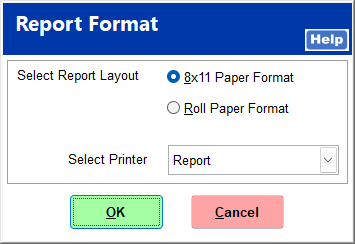

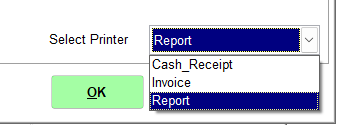

Select the report layout and the type of printer for the report.

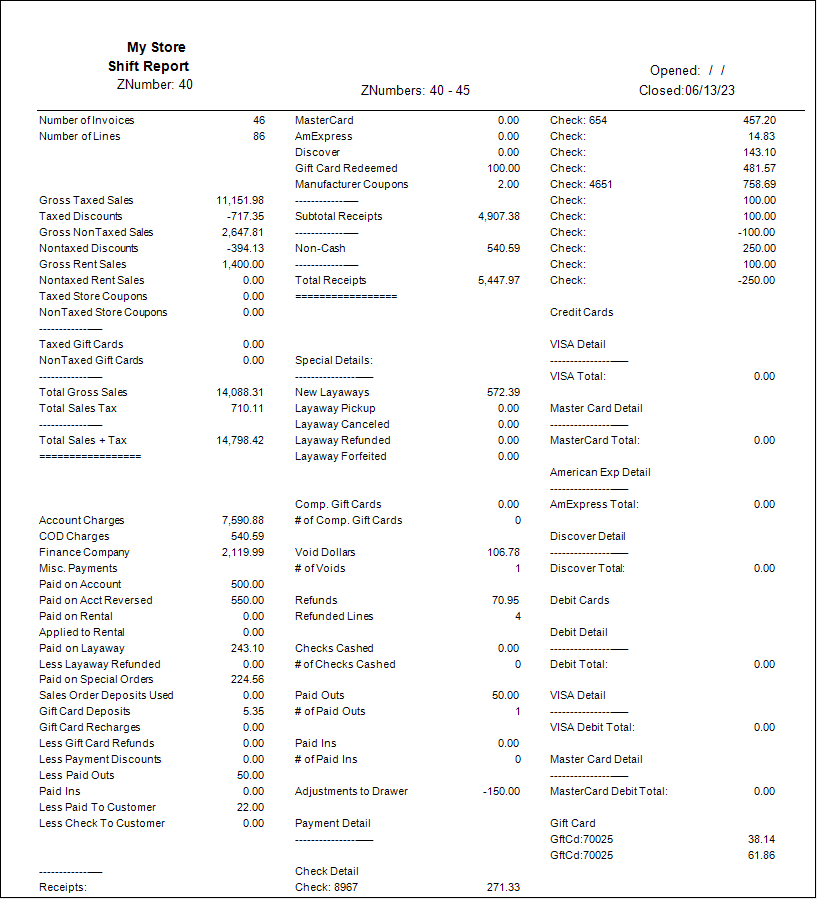

The Shift Report contains several different sections:

-

Number of invoices and lines

-

Sales totals

-

Account charges and payment activities

-

Receipts

-

Special Details (voids, refunds, checks cashed, paid outs)

-

Payment detail

Here is an example of a shift report:

The table below indicates the report field and the definition of the field's contents.

|

Field

|

Definition

|

|

Number of Invoices

|

Total number of invoices created during the shift for a specific workstation

|

|

Number of Lines

|

Total number of invoice lines created during the reported shift.

|

|

Gross Taxed Sales

|

The gross taxed sales value is the total sales prior to any discounting.

|

|

Taxed Discounts

|

The taxed discounts represents the amount of taxed discounts taken during the indicated shift.

|

|

Gross Non-taxed Sales

|

The gross non-taxed sales value is the total non-taxed sales prior to any discounting of non-taxed items.

|

|

Non-taxed Discounts

|

Non-taxed discounts represents the amount of non-taxed discounts taken during the indicated shift.

|

|

Gross Rent Sales

|

The gross rent sales is the total rental sales.

|

|

Non-taxed Rent Sales

|

The non-taxed rent sales are rental sales that were made under a non-tax customer.

|

|

Taxed Store Coupons

|

This will show the amount of any coupons that were taxed.

|

|

Non-taxed Store Coupons

|

This will show the amount of any coupons that were not taxed.

|

|

Total Gross Sales

|

Total Gross Sales represents the total sales less discounts

|

|

Total Sales Tax

|

Total collected sales tax

|

|

Total Sales + Tax

|

Total sales plus collected sales tax

|

|

Account Charges

|

The account charge line item indicates the amount of customer value charges created during the shift range.

|

|

COD Charges

|

The COD charge line item indicates the amount of cash on delivery charges created during the shift range.

|

|

Finance Company

|

The finance company line item indicates the amount customer finance charges created during the shift range.

|

|

Misc. Payments / Paid on Account

|

Since customers may remit account payments at the point of sale counter, the total amount of account payments is represented here.

|

|

Misc. Payments / Paid on Acct Reversed

|

This field shows the payments on accounts that was reversed due to an incorrect payment and so forth.

|

|

Misc. Payments / Paid on Rental

|

The amount paid on rentals during the shift range is displayed in this field.

|

|

Misc. Payments / Applied to Rental

|

The actual amount applied to rentals is shown in this field.

|

|

Misc. Payments / Paid on Layaway

|

As with Paid on Account, customer payments for layaway are accumulated within this line item.

|

|

Misc. Payments / Deposit on Layaway

|

When a layaway is created, the customer provides a deposit. This line item contains the total of the layaway deposits posted for the shift.

|

|

Misc. Payments / Gift Card Deposits

|

If the gift card option is included, the total gift card

|

|

Misc. Payments / Less Gift Card Refunds

|

This will show the amount refunded onto gift cards during the period.

|

|

Misc. Payments / Less Payment Discounts

|

If a customer receives a payment discount due to their payment terms, the discount value is totaled within this line item.

|

|

Misc. Payments / Less Paid Outs

|

The paid out value indicates the amount of cash removed from the workstation’s cash drawer for payment of ancillary expenses.

|

|

Receipts / Cash

|

Cash receipts posted during the shift

|

|

Receipts / Checks

|

Checks receipts posted during the shift

|

|

Receipts / Visa

|

Visa credit card receipts posted during the shift

|

|

Receipts / MasterCard

|

MasterCard credit card receipts posted during the shift

|

|

Receipts / Am Express

|

American Express credit card receipts posted during the shift

|

|

Receipts / Discover

|

Discover credit card receipts posted during the shift

|

|

Receipts / Other Cards

|

Other credit card receipts posted during the shift

|

The shift report can also be accessed at any time through POS | Reports | Z-Number.