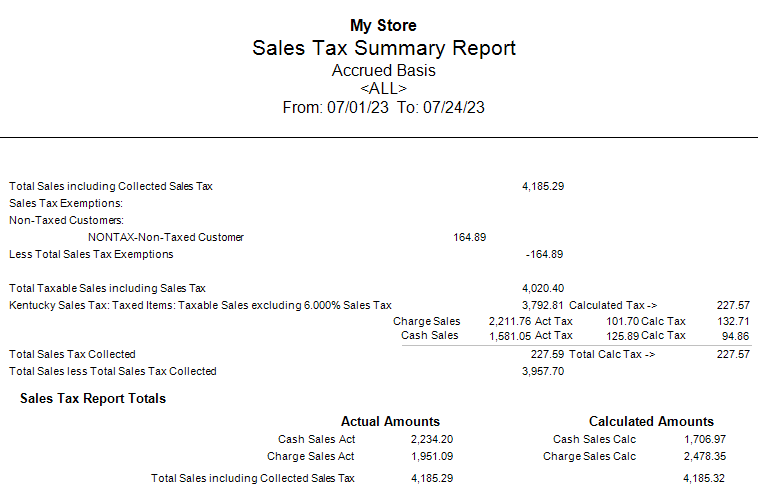

The Sales Tax Report provides a Sales Tax Summary Report and Non-Taxed Sales Report.

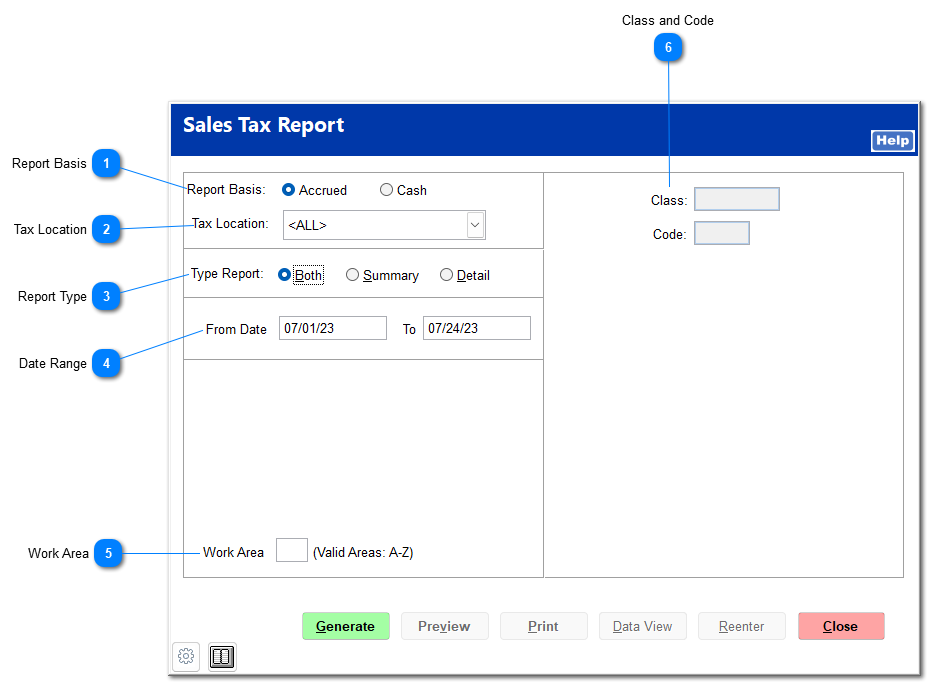

Report BasisSelect whether you wish to report on an accrued or cash basis.

|

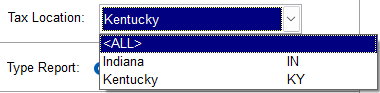

Tax LocationSelect the tax location to report on if applicable. This is set to all locations by default.

|

Report TypeSelecting Both generates both a summary and a detailed report.

A summary report shows total taxed and non-taxed sales, with break-outs by tax location, cash and charge sales, and actual and calculated amounts.

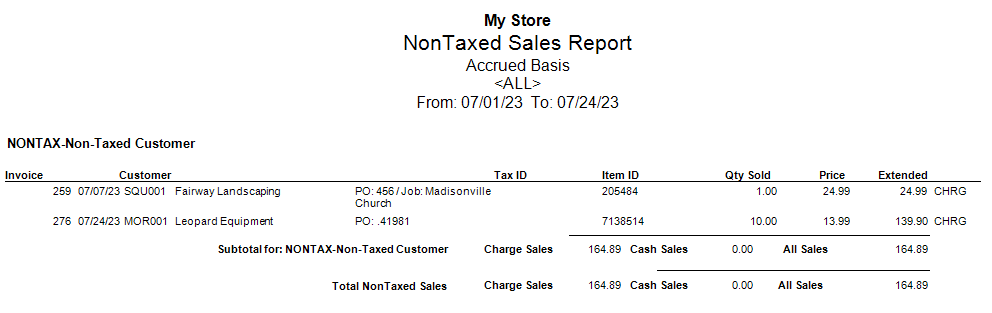

A detailed report shows total details for non-taxed sales, including invoice number, customer ID and job, and item details.

|

Date RangeEnter a date range.

|

Work AreaWithin System > Workstation > Work Area, single letter assignment allows to the operation to segregate areas of the store based upon specific functions. Hardware store sales tax versus Convenient store sales tax. |

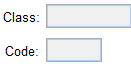

Class and CodeYou can filter results by class and code. This is only applicable to the detailed report type.

|

Here is an example of a summary report:

Here is an example of a detailed report: