Ag Tax Setup and Example Transactions

The "AG Tax" option provides an automated solution to unique customer based taxation instances.

AG Tax Example

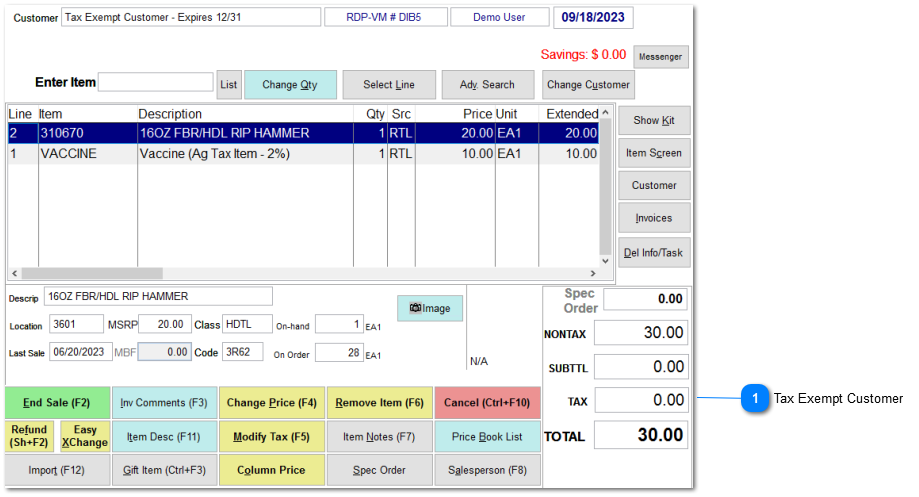

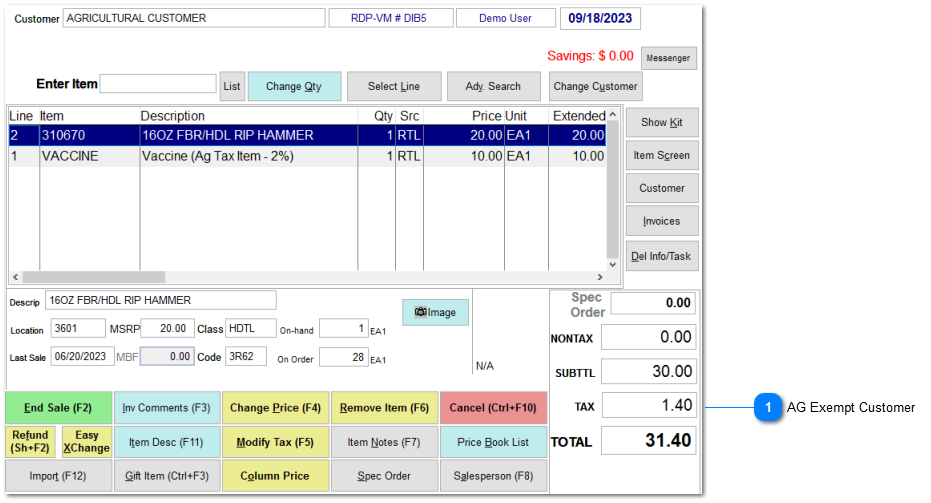

"Vaccine" is normally either a taxed or non-taxed item based upon the customer's tax status. If select customers have a unique taxation for the "Vaccine", the Ag Tax will automatically assign the appropriate taxation to the item based upon the customer's setup.

|

|

|

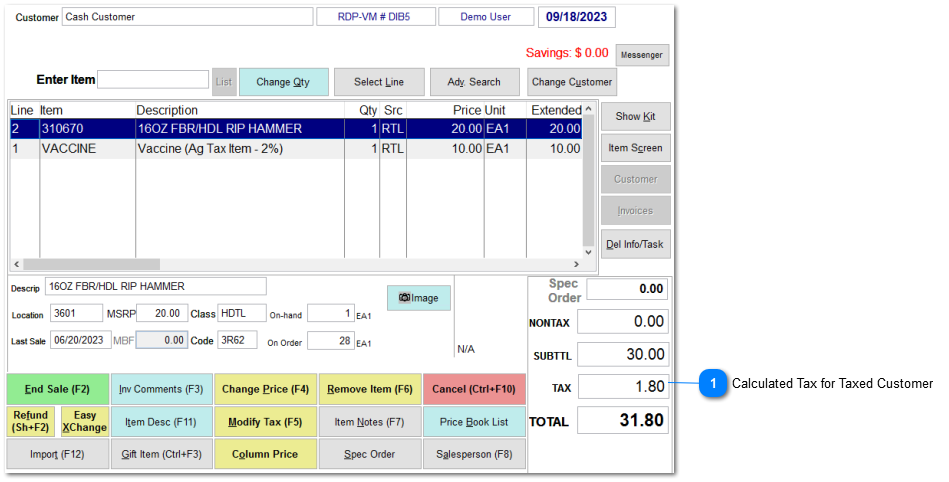

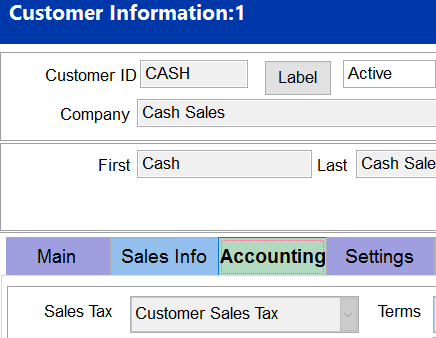

Taxed Customer

|

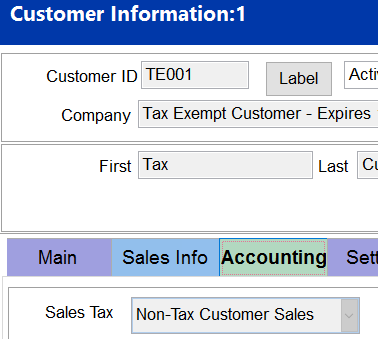

Tax Exempt Customer

|

AG Exempt Customer

| |||

|

Item

|

Price

|

Tax Rate

|

Calcualted Tax

|

Tax Rate

|

Calcualted Tax

|

Tax Rate

|

Calcualted Tax

|

|

Vaccine (Ag)

|

$10.00

|

6.00%

|

$0.60

|

0.00%

|

$0.00

|

2.00%

|

$0.20

|

|

Hammer

|

$20.00

|

6.00%

|

$1.20

|

0.00%

|

$0.00

|

6.00%

|

$1.20

|

|

Total

|

|

|

$1.80

|

|

$0.00

|

|

$1.40

|

Example:

The concept of an AG Tax is used to explain the broader explaination of the TransActPOS tax calculation controls. This tax control could be applied to any number of similar taxation subjects.

Setup of various control fields

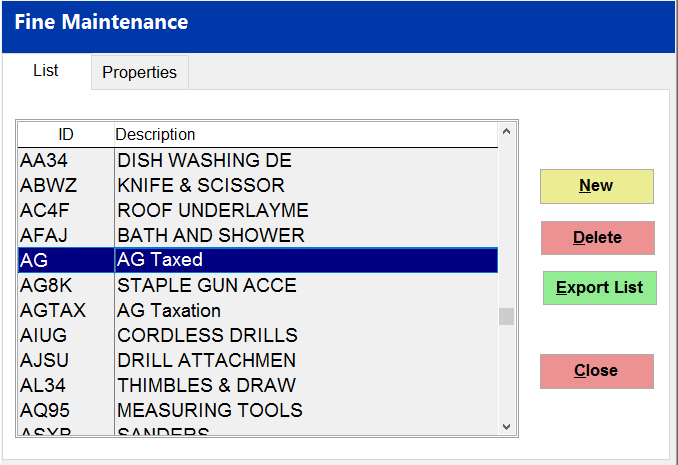

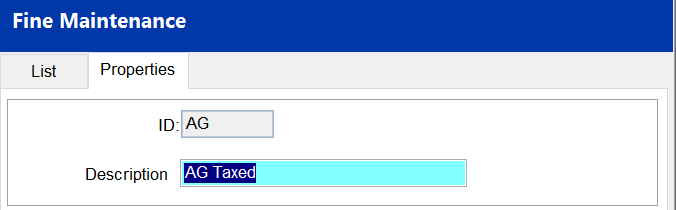

Additonal Item Level Control via the Fine field

Within IC, Support Files, Fine, create an "AG - AG Taxed" ID that will be assigned to inventory items that fall into this particular taxation category.

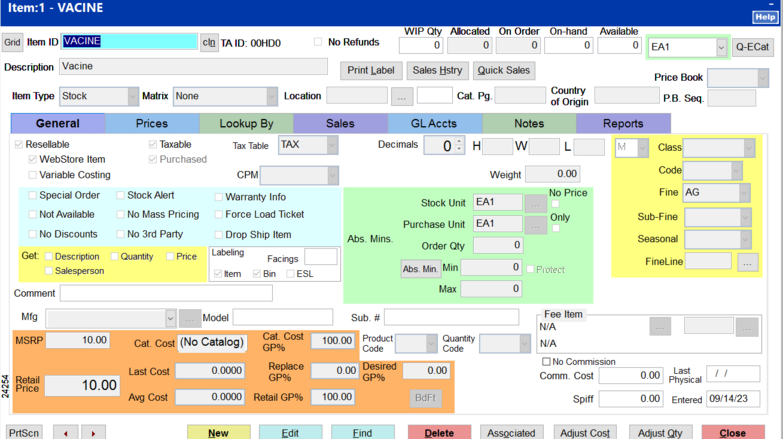

Assigning the Fine value to inventory

Locate each item that will have the AG taxation designation, select Edit and then assign the Fine value of AG.

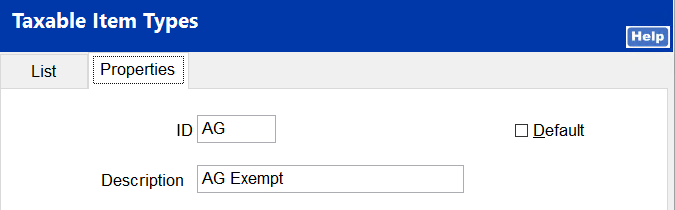

Create the Taxable Item Type: "AG Exempt"

Within System, Support Files, Sales Tax Menu, Taxable Item Types, create An ID of AG with a Description og AG Exempt.

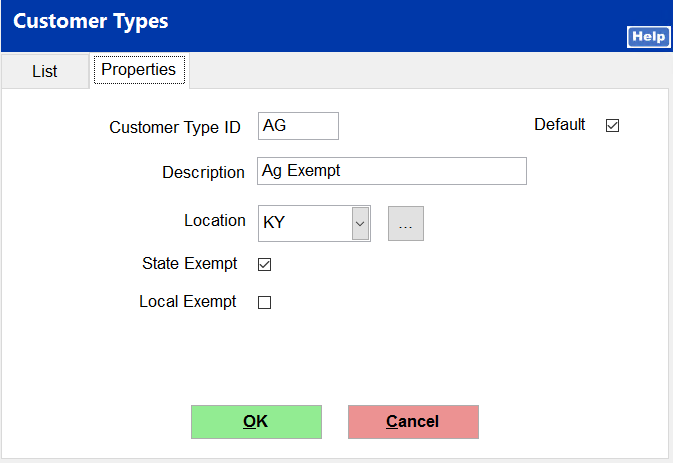

Create the Customer Type: "AG Exempt"

Within System, Support Files, Sales Tax Menu, Customer Types, create An ID of AG with a Description of AG Exempt.

Assign the apporpriate location which should coincide the the store's location.

Importand Note: Exemptions

-

Check the State Exempt

-

Uncheck the Local Exempt

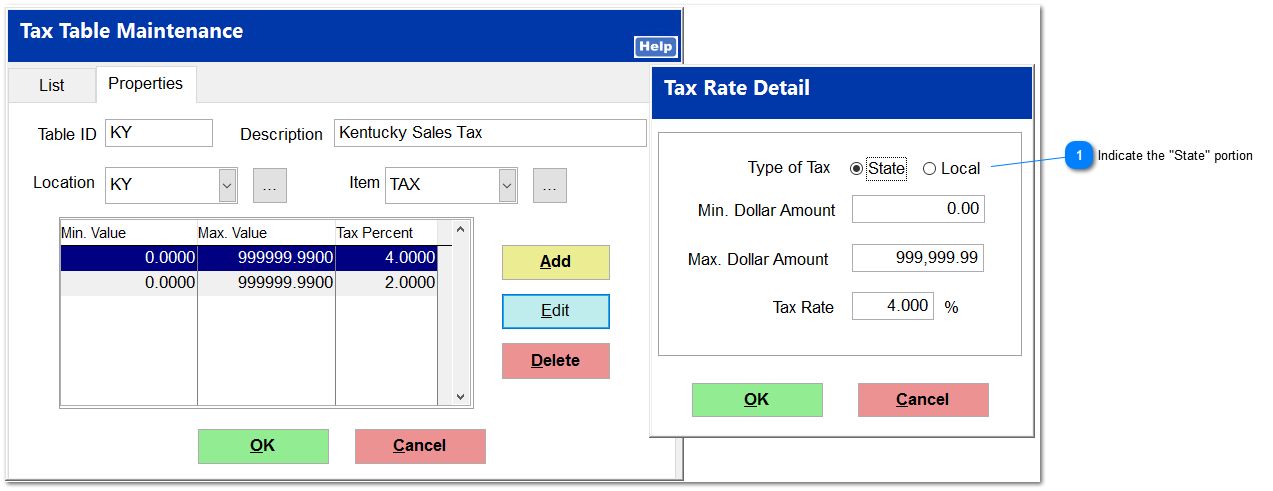

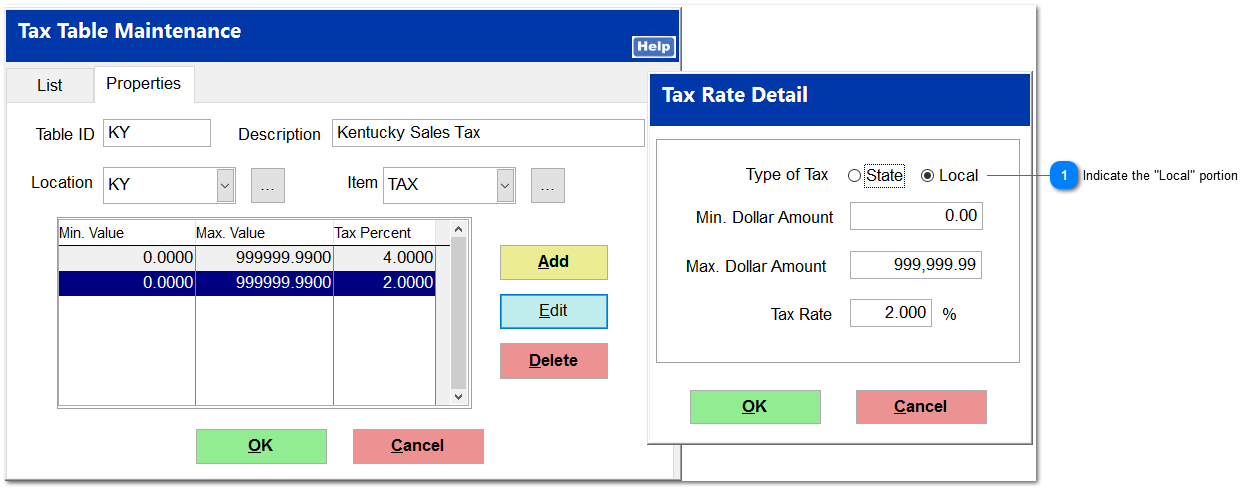

Modity the State Tax Table

Within System, Support Files, Sales Tax Menu, Tax Tables, modify the tax table to reflect the portion of tax applicable to the AG items. In this example, the Kentucky 6% sales tax has been modi

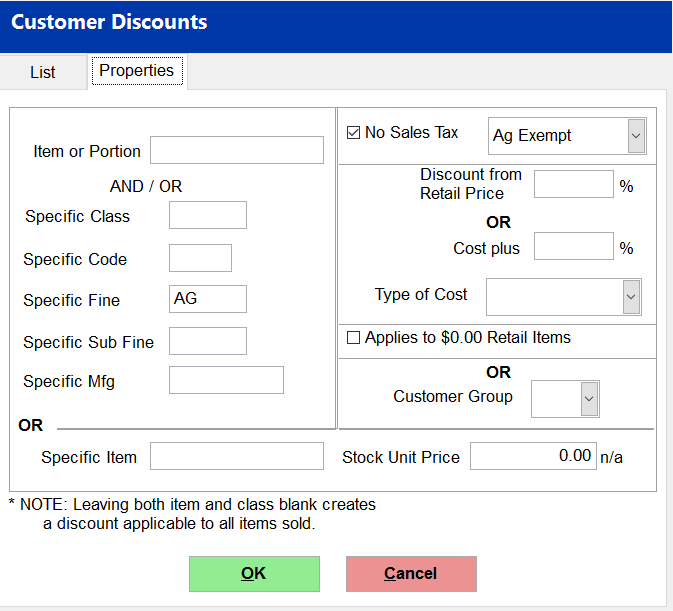

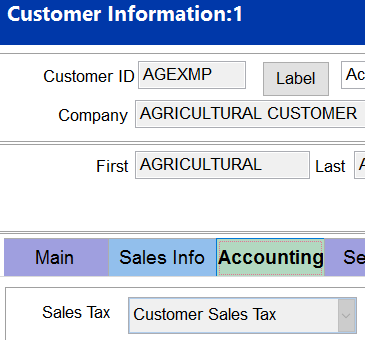

Assign the AG Fine with a tax exemption within the Customer Setup

-

Locate the customer within the Customer File.

-

Select the Settings tag, and then select Pricing Discounts, select All Discounts, select New.

-

Enter into the Specific Fine the "AG" value previously created in the above step.

-

Check the "No Sales Tax" option and then select the "Ag Exempt" taxation.

-

Select OK to save this selection.