Capital One Trade Credit (BlueTarp)

Capital One Trade Credit, formerly known as BlueTarp Financial, is a business-to-business (B2B) trade credit financing company. Let's explore its significance and offerings:

Background

BlueTarp Financial was a well-established company specializing in trade credit solutions. In 2019, Capital One Financial Corporation acquired BlueTarp, integrating its capabilities into Capital One's suite of financial services.

What Does Capital One Trade Credit Offer?

B2B Credit Management Programs:

-

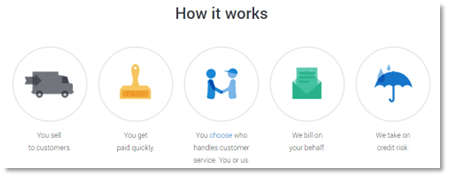

Capital One Trade Credit delivers customized credit management solutions to merchants and small- to medium-sized businesses (SMBs).

-

These programs help businesses manage their credit lines, streamline payments, and optimize cash flow.

Purchase-to-Payment Services:

-

The acquisition of BlueTarp enhances Capital One's offerings in purchase-to-payment processes.

-

It provides end-to-end solutions for businesses, from procurement to payment.

Augmented B2B Finance Capabilities:

-

Capital One aims to strengthen its B2B finance capabilities through this acquisition.

-

The goal is to better serve SMBs and provide tailored credit solutions.

Benefits for Businesses:

-

Efficiency: Streamlined credit management processes save time and resources.

-

Risk Mitigation: Proper credit management reduces the risk of non-payment and financial losses.

-

Financial Flexibility: Businesses can access credit when needed for growth and operations.

In summary, Capital One Trade Credit (formerly BlueTarp Financial) offers B2B credit management programs, empowering businesses with customized solutions to manage credit effectively.