Example of a Tax Variance by Location with reports

For Example

At three locations, propane is sold but at one of the locations the local tax rate is 10% versus the standard 7%.

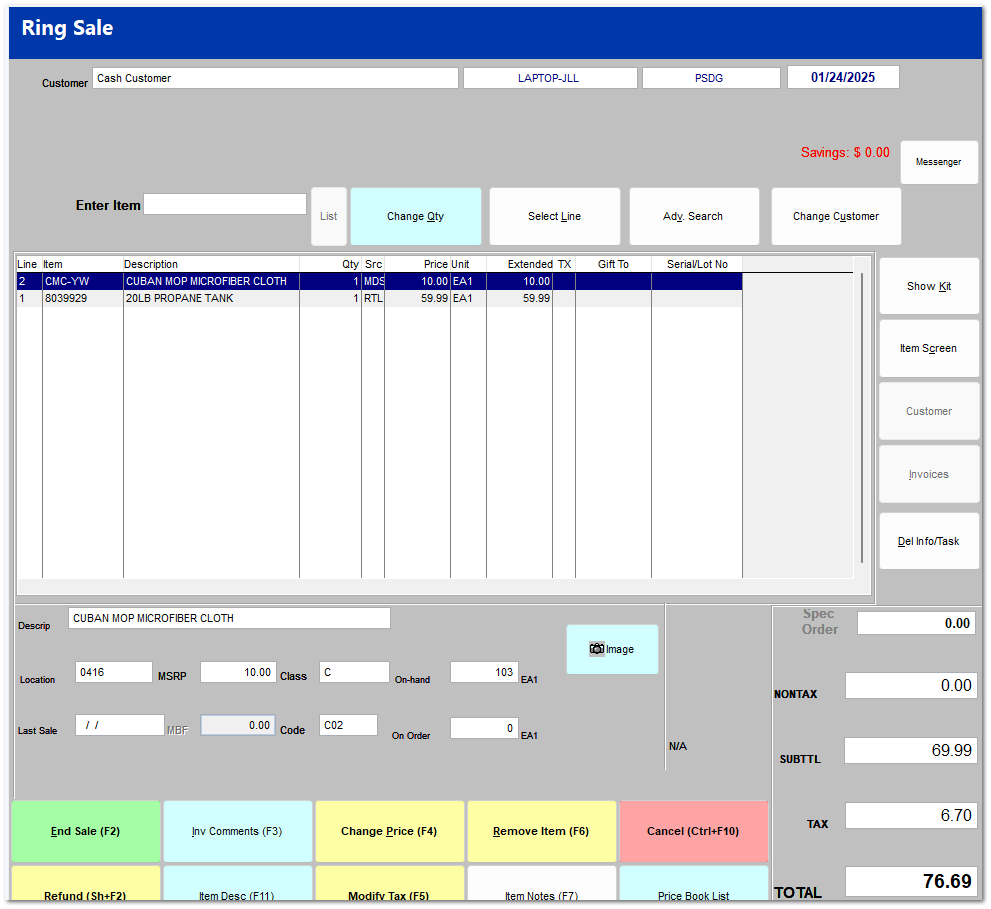

In the example below, line 1, the propane product is sold for $59.99 while Line 2 is sold for $10.00.

The system calculated the tax for the propane at $6.00 (rounded 10% of 59.99) and the $0.70 for a total tax of $6.70.

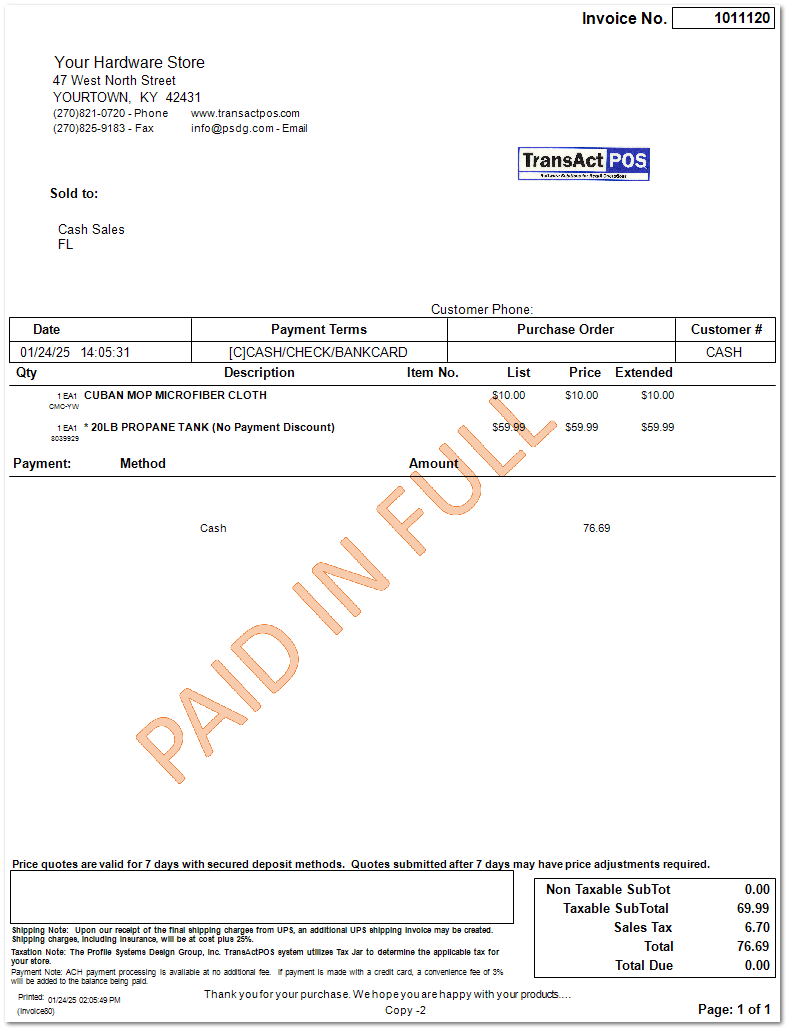

On the invoice the tax is reflected within the totals.

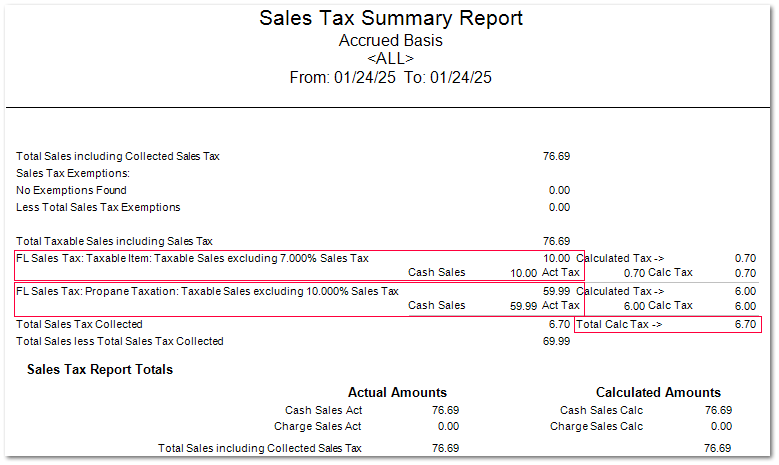

Within the Sales Tax Report, the system reports the Total Sales Including Collected Sales Tax and categorizes the Taxable Items and the Propane Taxation as separate reported rates. Additionally the Total Calculated Tax of $6.70 is presented within the report.