Setup at the Individual Stores

Go to each location and create a specific taxation for the "P10" items as shown in this example.

-

Store 1 - the tax rate of P10 items is 7%

-

Store 2 - the tax rate of P10 items is 7%

-

Store 3 - the tax rate of P10 items is 10%

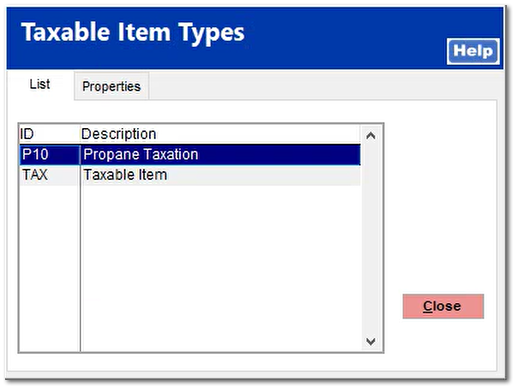

With the "Setup the tax structure at the Home Office" step completed within a couple of minutes, the Multi-Store system has communicated the new core tax structure to the other stores. Specifically, the new Taxable Item type of "P10" will appear within the stores System > Support Files > Tax Tax Menu > Taxable Item Type listing.

Note: As with many of the System Level changes, the user must exit TransActPOS and then return to pickup the new configuration. So, make it a practice to select Exit, Exit and to leave TransActPOS to pick changes.

|

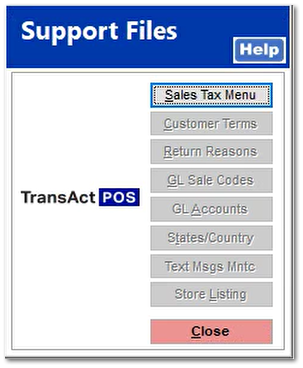

Arriving at the Support Files page, the store's system has grayed out those functions that are exclusively controlled by the TransActPOS Home Office. In this case, only the Sales Tax Menu is available. Select this option.

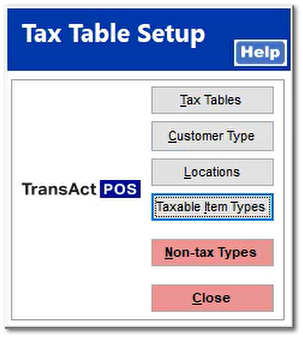

Selecting the Taxable Item Type button will reveal the P10 - Propane Taxation taxable item type. Select Close to return to the prior menu.

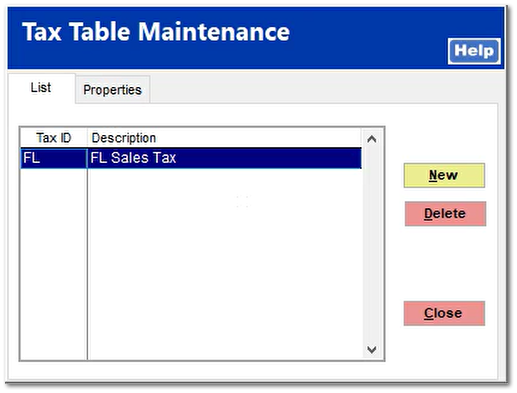

Select Tax Tables to create the tax rate for the Item Type "P10".

Select New

Complete the following fields:

-

Table ID: The Table ID is typically the state's two character abbreviation.

-

Description: The description will appear within the Sale Tax Report so make this description recognizable

-

Location: The location is typically the state's two character abbreviation.

-

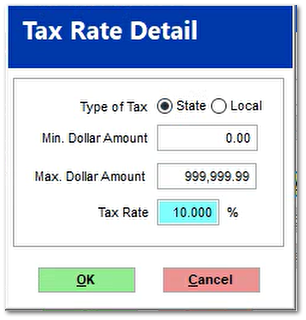

Item: The Item field should reflect the group of items that will have their taxable item type indicated as "P10", as in this example.Select Add to continue to the Tax Rate Detail page

To this point, this process will be completed on each store location's system.

The only difference will be the assigned tax rate per store.

-

Store 1 - the tax rate of P10 items is 7%

-

Store 2 - the tax rate of P10 items is 7%

-

Store 3 - the tax rate of P10 items is 10%

In this example, this is store 3 which will be assigned a Tax Rate of 10%.

Select OK to complete and return to the testing phase to confirm your desired results.

Note: As with many of the System Level changes, the user must exit TransActPOS and then return to pickup the new configuration. So, make it a practice to select Exit, Exit and to leave TransActPOS to pick changes.

|