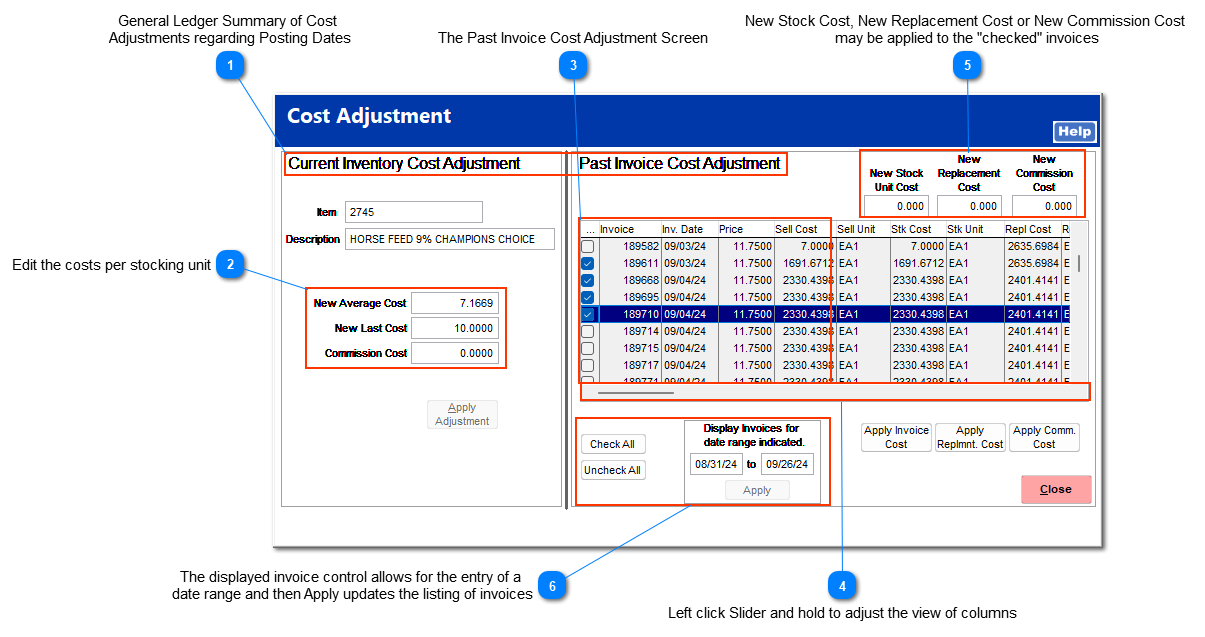

The adjust cost function allows the user to change the cost of the selected item. If this is a stock item, the inventory and adjustment accounts specified within the System | Company Setup will post the appropriate journal entries for the posting.

General Ledger Summary of Cost

Adjustments regarding Posting Dates| | Current Inventory Adjustments creates General Ledger postings dated today's date.

Past Invoice Cost Adjustments creates General Ledger postings for the date of the ORIGINAL Invoice Date.

|

|

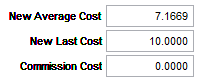

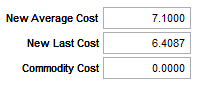

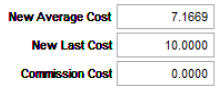

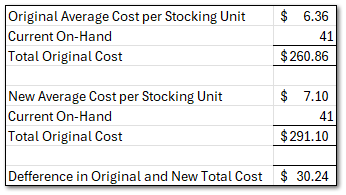

Edit the costs per stocking unitEditing the New Average Cost, New Last Cost, and the Commission Cost changes the indicated value for the SKU and does not change the historic costs. After entering the Apply Adjustment button,  , is available to complete the posting. A change to the New Average Cost will generate a posting to the General Ledger Distribution report and will post a Inventory and Adjustments posting according to the setup of GL Pages 1, 2 & 3.

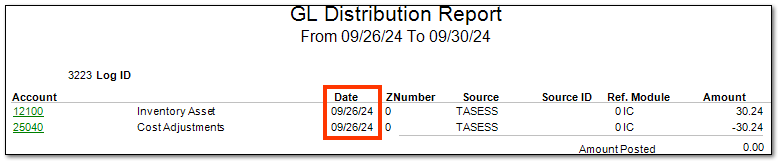

| | The above example does create Inventory Asset and Cost of Goods Sold adjustments postings on the date the cost adjustment was made, today's date.

|

|

|

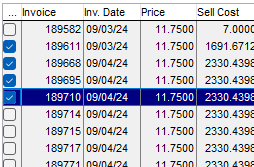

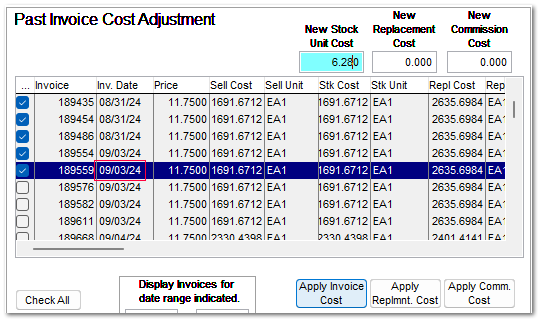

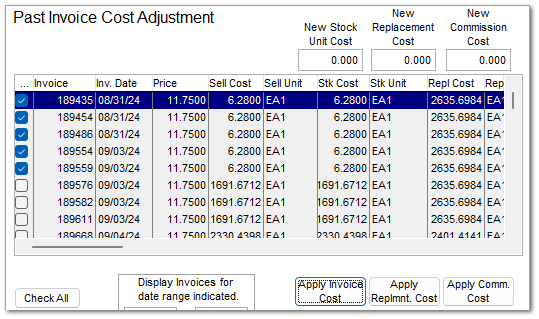

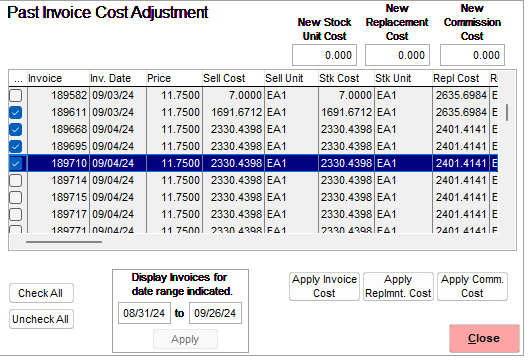

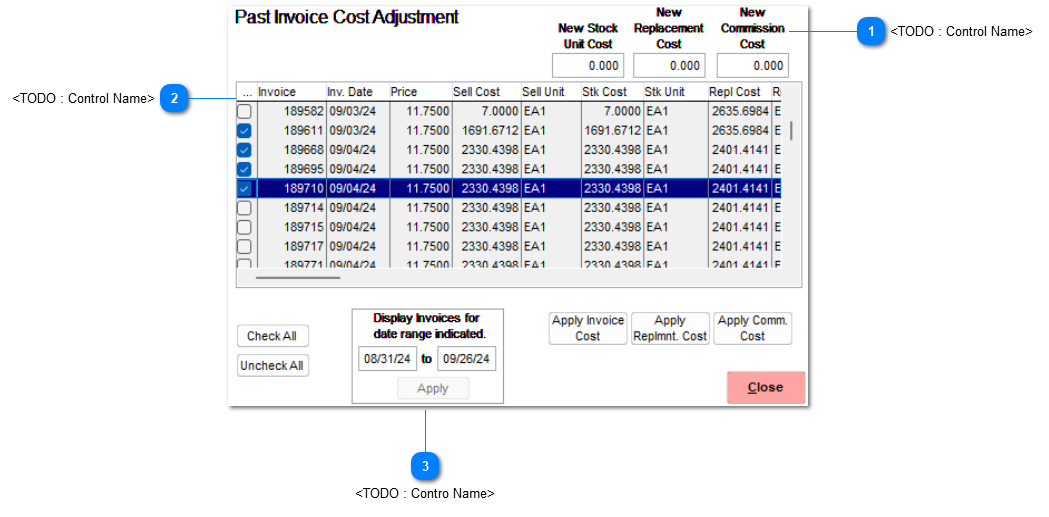

The Past Invoice Cost Adjustment ScreenThe Past Invoice Cost Adjustment Screen allows the user to correct cost of historic invoices.

|

New Stock Cost, New Replacement Cost or New Commission Cost

may be applied to the "checked" invoices

Entering a New Cost into the indicated field will update the cost of the checked invoices.

In this example, the 6.260 cost will replace the 1,691.6712 cost once the Apply Invoice Cost is selected. An example of this application of New Stk Cost is presented below.

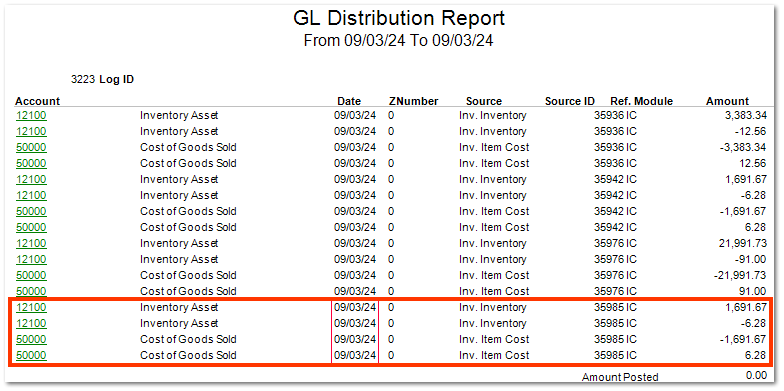

General Ledger effect of a New Stock Unit Cost Adjustment

| | The above example does create Inventory Asset and Cost of Goods Sold adjustments postings on the original invoice date.

|

The original Inventory Asset account and the associated Cost of Goods Sold are reversed. The new cost is then reflected with two correcting postings to the Inventory Asset Account and the Cost of Goods Sold account.

|

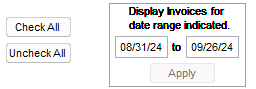

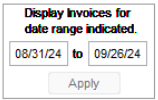

The displayed invoice control allows for the entry of a

date range and then Apply updates the listing of invoicesThe Check All and Uncheck All buttons toggle the left column of check boxes, determining which invoices will have their specified costs updated.

|

<TODO : Control Name><TODO>: Insert description text here...

|

<TODO : Control Name><TODO>: Insert description text here...

|

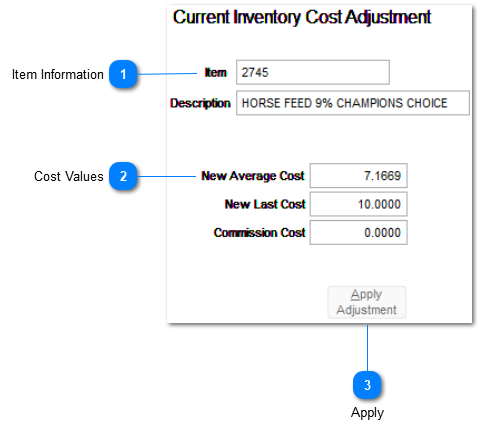

Current Inventory Cost Adjustment

Current Inventory Adjustments creates general ledger postings dated today's date.

Item InformationThe item ID and description for the current item are displayed.

|

Cost ValuesEditing the New Average Cost, New Last Cost, or Commission Cost changes the indicated value for the SKU but does not change the historic costs. A change to the New Average Cost generates a posting to the General Ledger Distribution report and generates an Inventory and Adjustments posting according to the setup of GL Account Pages 1, 2, and 3.

|

Apply After entering a value in each field, the Apply Adjustment button becomes available to complete the posting.

|

Past Invoice Cost Adjustment

Past Invoice Cost Adjustments creates general ledger postings for the date of the original invoice date and allows the user to correct cost of historic invoices.

<TODO : Control Name>

|

<TODO : Control Name><TODO>: Insert description text here...

|

<TODO : Contro Name><TODO>: Insert description text here...

|