Review of an AG Exemption Sale

1. Company Setup

Turn on the System > Company Setup > Inventory Page 3 >

AG Tax Feature.

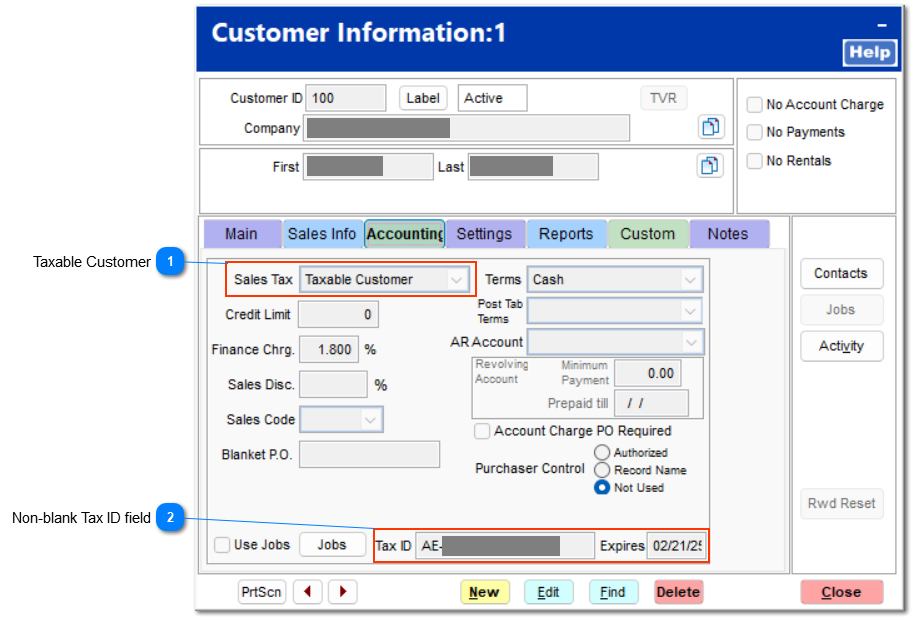

2. Customer Setup

Taxable CustomerConfirm that the customer is set to Sales Tax > Taxable Customer.

|

Non-blank Tax ID fieldWithin the Customer File > Accounting tab, enter the customer's AG/Farm Exempt Certificate number and the Expiration date.

If the certificate is not present, a non-blank value could be placed in the field (e.g. TBA - to be assigned). The Tax ID will be presented within the Sales and Use tax reporting to reconcile the transactions with valid Tax IDs. To remove the TBA references from the Sale and Use Tax report, update the customer's Tax ID and then rerun the report.

|

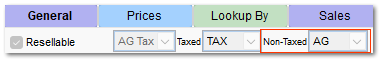

3. Inventory Setup

Having exited and returned to the the TransActPOS application after selecting the AG Tax feature, compile a list of the items that are eligible for the AG Exempt status..

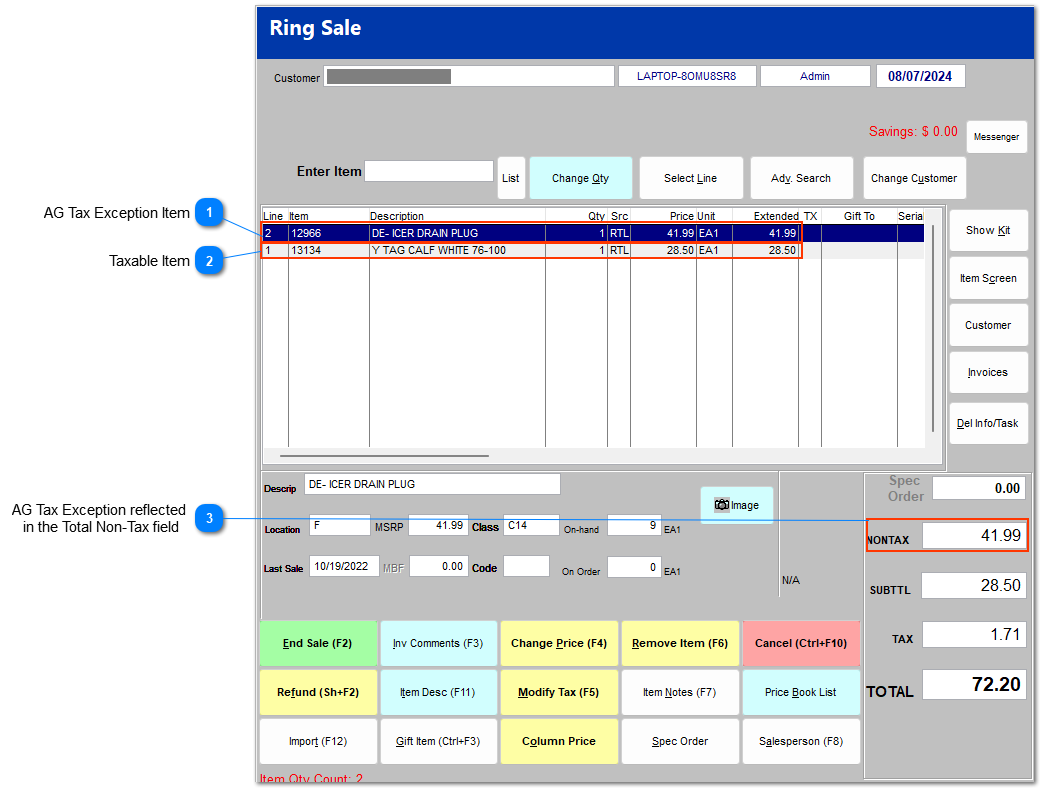

4. Create the Sale

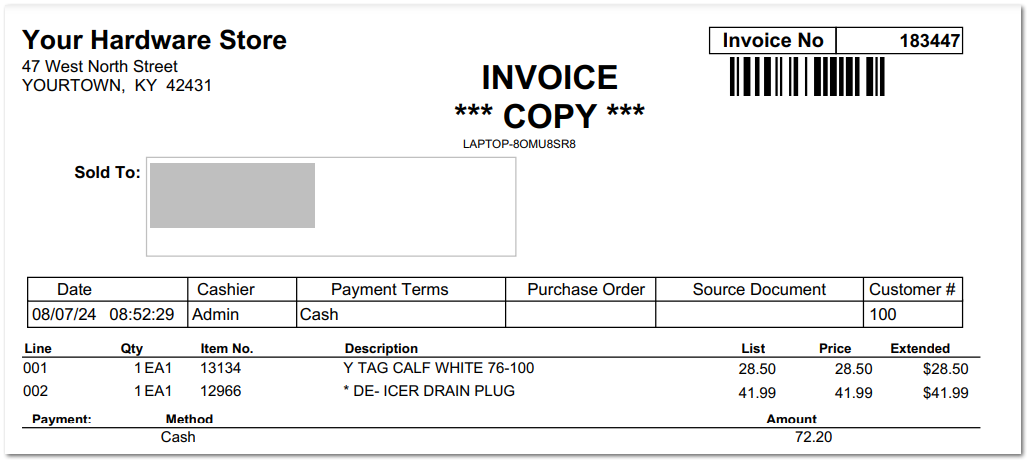

AG Tax Exception ItemItem 12966 is an AG taxable item based upon the  selection within the IC > File Maintenance > General tab.

In this example, item 12966 has been selected as an AG Tax item with both the Taxed and Non-Taxed values indicated.

When this item is sold to the Taxable Customer with a non-blank Sales Tax ID, the item is then automatically changed a Non-Taxed AG status on the current invoice.

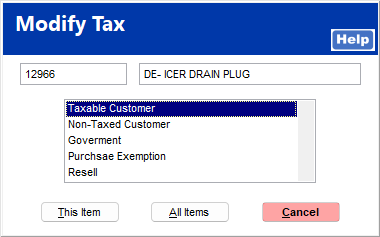

If the customer's use is outside of the AG Tax exception usage and the item should be taxed, use the Modify Tax (F5) to change the item's taxation to Taxable Customer for the selected item.

| | If it is determined that the item should be tax-exempt after the Modify Tax (F5) has been applied, select Remote Item (F6) and then re-enter the item into the detail screen.

|

|

Taxable ItemItem 13134 is a taxable item based upon the  selection selection within the IC > File Maintenance > General tab.

In this example, item 13134 is a Taxable item and tax will be applied to the invoice for this customer.

|

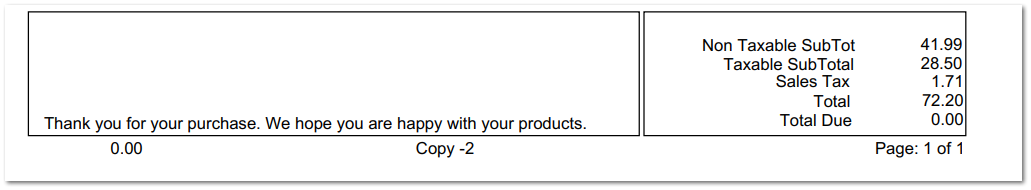

AG Tax Exception reflected

in the Total Non-Tax field |

Example of resulting Invoice

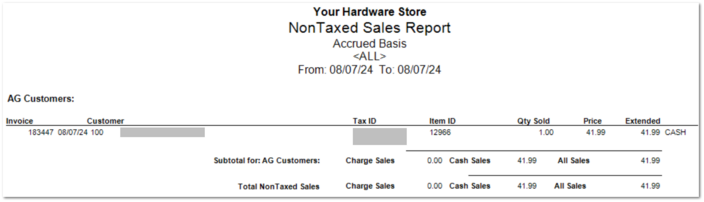

5. Sales and Use Tax Reporting

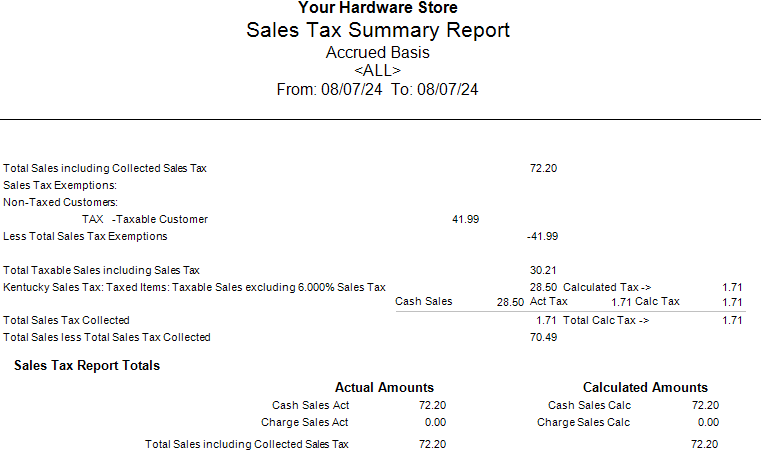

Sales Tax Summary Report

Sales Tax Detail Report