AG Taxation Feature

The AG Taxation Feature allows a taxation of non-tax status to automatically be applied to selected agricultural items.

Turn on the AG Taxation FeatureGo to System | Company Setup | Inventory Page 3, and check the AG Taxation Feature. Once completed, at each workstation, exit TransActPOS (Exit, Exit) and then return to the TransActPOS to pickup this company setting.

|

Company Setup - AG Taxation Feature set to Not Option

Option Turned Off - Default

When the Ag Tax Option is unchecked, items are indicated as Taxable within the General tab of the item Ag Tax Items (Agricultural) which are non-taxable for Taxable customers with a non-blank Tax ID.

|

Customer

|

Taxable Customer

|

Non-Taxed Customer

|

Taxable Customer with Tax ID

|

|

Item

|

Taxable Item

|

Taxable Item

|

Taxable Item

|

|

Results

|

Tax applied to Item

|

Tax NOT applied to Item

|

Tax IS applied to Item

|

|

Comment

|

|

|

If the item is determined to be a non-taxable item based upon the Ag taxation rules and the customer's use of the item, the user selects Modify Tax (F5) to change to AG Tax (non-taxed).

|

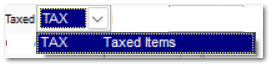

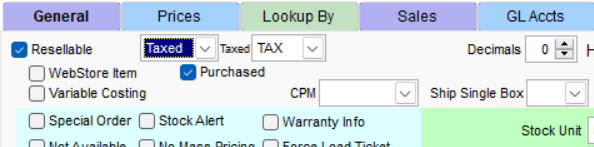

Taxed Item with selected Taxed Category of TAX

Non-Taxed Item with selected Tax-exempt Food

Company Setup - AG Taxation Feature set to Non-Taxed

When the Ag Taxation Feature is checked, items are identified as Ag Tax Items (Agricultural) which are non-taxable for Taxable customers with a non-blank Tax ID.

|

Customer

|

Taxable Customer

|

Non-Taxed Customer

|

Taxable Customer with Tax ID

|

|

Item

|

Taxable Item

|

Taxable Item

|

Taxable Item

|

|

Results

|

Tax applied to Item

|

Tax NOT applied to Item

|

Tax IS NOT applied to Item automatically

|

|

|

|

|

If the item is determined to be a Taxable item based upon the AG taxation rules and the customer's use of the item, the user selects Modify Tax (F5) to change to Taxable Item.

|

AG Taxed item with optional Non-Taxed

|

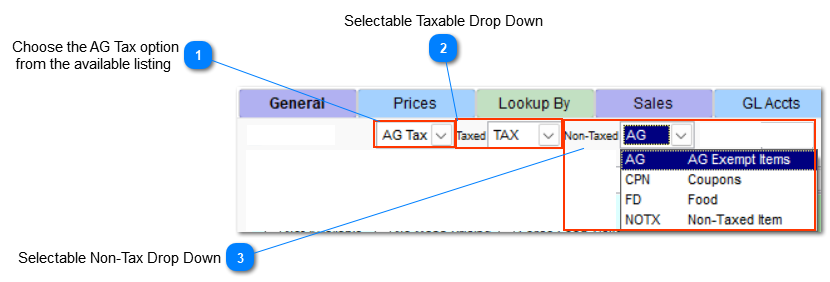

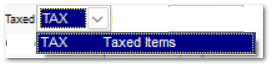

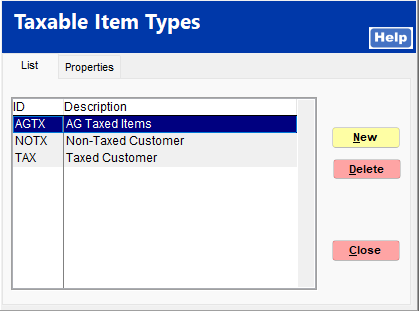

Choose the appropriate Taxable tax from the available listing. The Taxable listing typically only contains a single entry, TAX. This listing of taxable items is supported within System > Company Setup > Sales Tax Menu > Taxable Item Types.

|

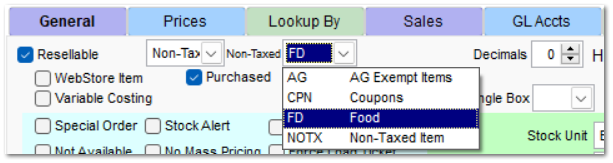

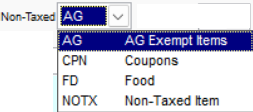

Choose the appropriate Non-Taxable from the available listing. The Non-Taxable listing will contain multiple non-tax items. In the case of the AG tax option, select the AG Tax item. The Sales Tax report will reflect the sales which have been automatically set to AG tax within the Sales and Use tax report within the AG summary and detail report.

The listing of non-taxable items is supported within System > Company Setup > Sales Tax Menu > Non-tax Types.

|

Company Setup - AG Taxation Feature set to Select Tax Rate

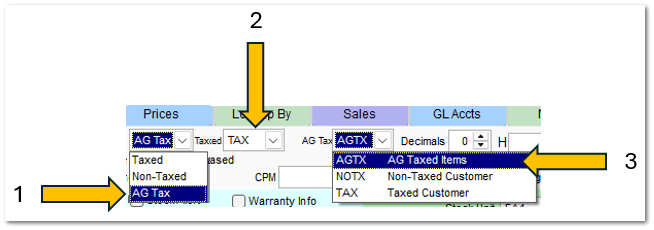

Set up Taxable Item Type for AGTX

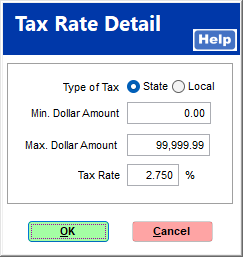

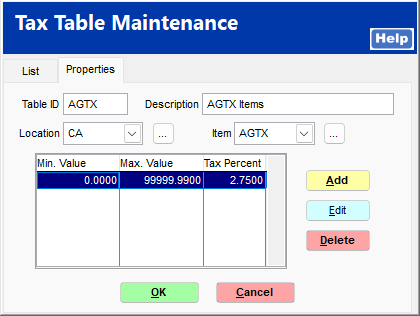

Establish Tax rate for AGTX

|

|

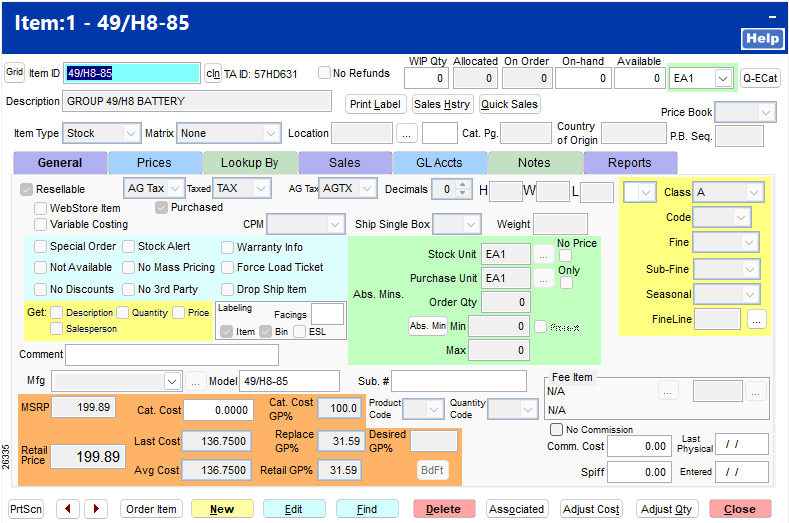

Apply AG Tax to the item

-

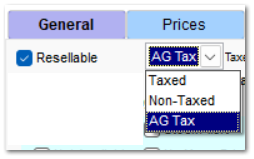

In this example, change the Tax Type to "AG Tax" as seen within "1".

-

Establish a "normal" tax rate as seen within "2".

-

Select the newly created "AGTX" that contains the new tax rate created within the step above (

Establish Tax rate for AGTX

).

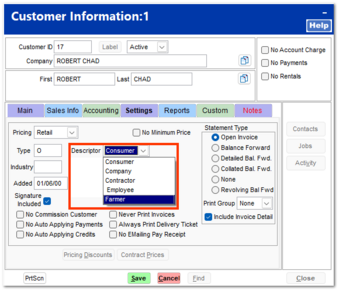

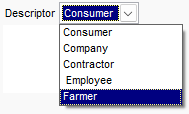

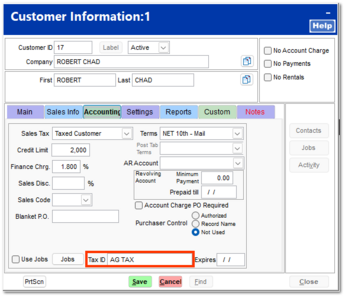

Apply the two requirements of AG Tax to the customer account

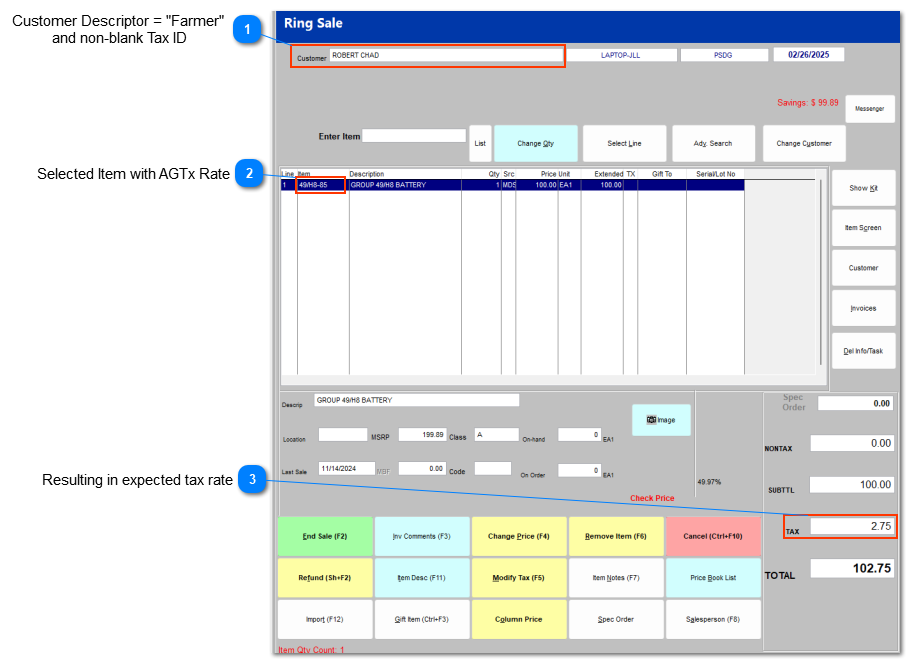

Sample Sale to Sample Customer

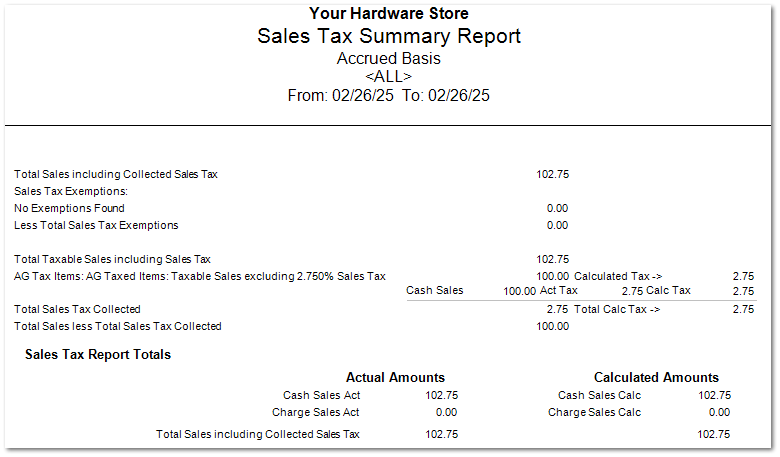

Sales Tax Summary Report for the above example

Sales and Use Tax Reporting

The TransActPOS > Reports > AR or IC, Sales Tax Report provides detailed reporting to reflect the Ag taxation instances.