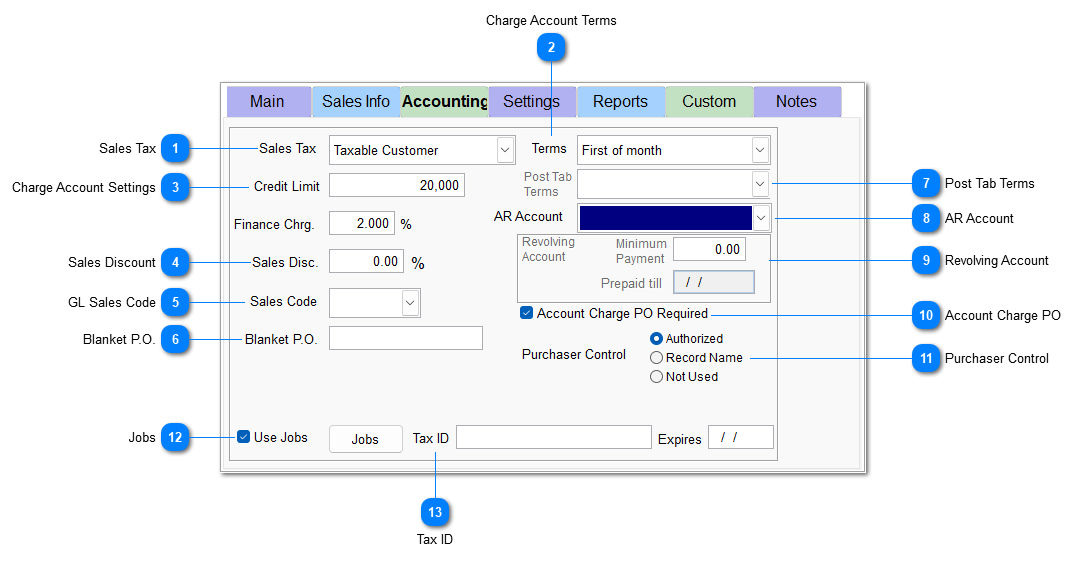

Accounting Tab

For more information about the Accounting tab, see the video 02-010-003 AR: Customer File - Accounting Tab.

The Accounting tab contains financial controls including taxation and account charge settings.

|

Select the appropriate tax type for the customer. Customer tax types are created in System | Support Files | Sales Tax Menu.

|

|

Select the appropriate customer payment terms. When a new customer account is created, the terms are entered using the default set in System | Company Setup | Accounts Receivable 1. It can be adjusted for each customer. Customer terms are created in System | Support Files | Customer Terms.

|

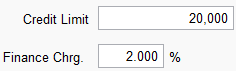

When a new customer account is created, the credit limit and finance charge are entered using the defaults set in System | Company Setup | Accounts Receivable 1. They can be adjusted for each customer.

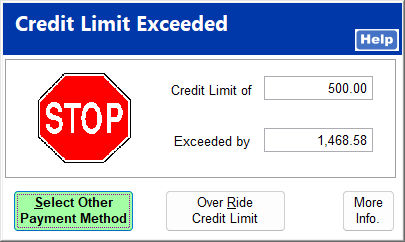

Credit limit is the maximum amount a customer is allowed to charge on credit. If an account charge transaction exceeds the credit limit, you are prompted to select a different payment method or obtain a manager override.

The finance charge is a monthly rate applied to an account that carries a balance.

|

|

This is the GL Customer Code that, in combination with the Item Code, determines to which GL accounts invoices are applied.

For more information on Sales Codes, see How Sales Codes Work. Sales Codes are created in System | Support Files | GL Sales Codes.

|

|

If tab invoices are used, select the correct terms. Note that Charge Account Terms must be set to Tab Invoices to enable Post Tab Terms. Tab Invoice terms are set in System | Company Setup | Accounts Receivable 1. For more information on Tab Invoices, see Tab Invoices.

|

|

This is the general ledger account to which accounts receivable postings are made during a sales or refund transaction. This is set in System | Company Setup | GL Accounts Page 1.

|

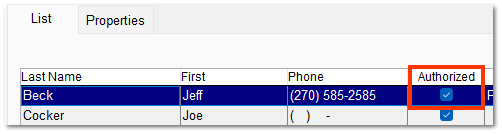

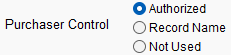

This controls who is allowed to charge to the customer account. Authorized allows only contacts marked Authorized to make charges. For more information on authorized contacts, see Contacts.

Record Name allows anyone to make charges but requires the name of the purchaser to be recorded at the Payment screen.

Not Used places no restriction on account charges.

|

|

This allows the customer to organize invoices into projects so that all transactions related to that project are organized and can easily be found. The box must be checked to enable jobs. For more information on setting up and using jobs, see Jobs.

|